Dear Shareholders,

On behalf of the Board of Directors of ELK-Desa Resources Berhad (“ELKDesa”), I am pleased to present the Annual Report and the Audited Financial Results of the Group and Company for the financial year ended 31 March 2016 (“FYE 2016”).

Economic and Industry Overview

It was reported that the Malaysian economy grew by 5.0% (2014: 6.0%), supported by the continued expansion of domestic demand. Growth of domestic demand was stronger during the early part of the year, partly reflecting the frontloading of consumption spending prior to the implementation of the Goods and Services Tax (GST) in April 2015. In the second half of the year, as growth in domestic demand moderated, a modest improvement in external demand provided additional impetus to economic growth.

Domestic demand was primarily driven by the private sector. Private consumption continued to expand, albeit at a more moderate pace. Despite concerns about the rising cost of living and weak sentiments, household spending was supported by continued income growth and stable labour market conditions. This was further supported by an increase in targeted Government transfers to low- and middle-income households, as well as the boost to disposable incomes from the lower fuel prices during the year.

Headline inflation declined to 2.1% in 2015 (2014: 3.2%). Inflation was lower in year 2015 largely due to the impact of the lower global energy and commodity prices, which more than offset the effects from a weaker ringgit exchange rate, the implementation of GST, and several upward adjustments in administered prices made towards the end of the year. In terms of categories, the decline in inflation during the year was due mainly to lower inflation in the transport and housing, water, electricity, gas and other fuels categories. However, it is also important to note that higher inflation rates were recorded in highly urbanised states such as Kuala Lumpur, Selangor, Putrajaya, Pulau Pinang and Johor in 2015. Furthermore, households in the lower income groups experienced higher inflation rates across most states in Malaysia.

The household loan disbursed for the purchase of passenger cars increased by 6.1% to RM46.3 billion in year 2015 and the total outstanding hire purchase loans granted for the purchase of passenger cars grew 6.7% to RM156.3 billion as at December 2015.

(Source: Bank Negara Malaysia Annual Report 2015 and Monthly Statistical Bulletin)

FYE 2016 Financial Performance and Operations Review

Group’s Overview

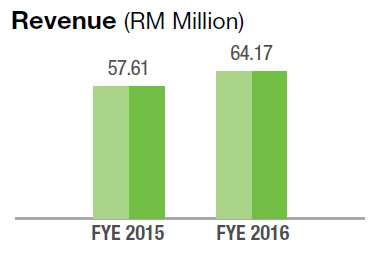

Revenue for the Group grew 11.4% from RM57.61 million to RM64.17 million mainly due to additional revenue from the new furniture segment. During the financial year, the Group has ventured into furniture business, involving in retailing, wholesale and export of home furniture products.

Profit before tax for the Group decreased marginally from RM25.49 million to RM25.32 million. The profit before tax was lower due to a one-off rights issue expenses of approximately RM1.00 million that was incurred during the financial year. Excluding the rights issue expenses, the profit before tax would have increased 3.3% from RM25.49 million to RM26.33 million.

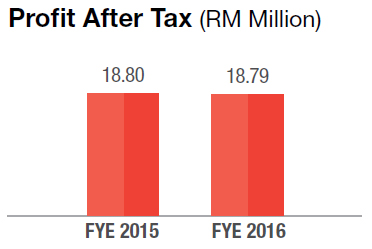

Profit after tax decreased marginally from RM18.80 million to RM18.79 million. The Group’s basic Earnings per Share (“EPS”) was 12.86 sen as compared to 15.04 sen of the previous financial year. The lower EPS was mainly a result of a larger share capital base after the issuance of 59,800,000 rights shares in October 2015.

The Group’s total assets expanded by 10.8% to RM371.90 million with cash reserves increased from RM52.64 million to RM77.39 million.

Bank borrowings reduced by 59.9% to RM15.51 million, resulting in a much lower gearing ratio of 0.10 and stronger financial position.

The shareholders’ funds increased by 23.7% to RM321.25 million, mainly due to the issuance of 59.8 million rights shares during the financial year. As at 31 March 2016, the Net Assets per Share (“NA”) stood at RM1.84. The NA for the Group includes an ICULS – equity component of RM83.28 million arising from the Renounceable Rights Issue of Irredeemable Convertible Unsecured Loan Stock (“ICULS”) of RM100 million in April 2014.

The return on average assets remained positive at 5.3% as compared to 6.4% in the previous year and the Group’s cash flow was healthy.

Hire Purchase Segment

Revenue for the hire purchase segment decreased by 2.9% from RM57.61 million to RM55.96 million, mainly due to lower hire purchase disbursement for the financial year, which is in line with the Group’s strategy to tighten its hire purchase disbursement policy.

Impairment allowance was lower by 7.0% from RM16.74 million to RM15.57 million. Profit before tax generated from this segment was marginally lower at RM25.29 million, after deducting the one-off rights issue expenses of RM1.00 million. Excluding the rights issue expenses, the profit before tax for the segment would have increased 3.2% from RM25.49 million to RM26.30 million.

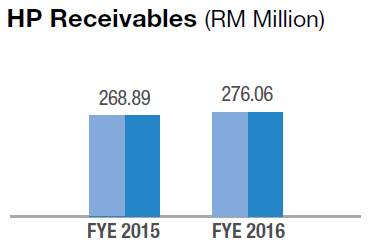

Hire purchase receivables, which is a major component of the Group’s total assets, grew at a slower rate of 2.7% to RM276.06 million at the end of FYE 2016, in view of the uncertain economic environment that had affected domestic business and consumer sentiments during the financial year.

In terms of asset quality, the Non-Performing Loans (“NPL”) ratio stood at a comfortable level of 1.2% and loan loss coverage at 286% as at 31 March 2016, as compared to 1.7% and 235% respectively that were recorded in the previous financial year. It is important to note that, after taking the value of the cars that have been repossessed into consideration, all known NPL has been fully impaired in our financial statements.

Furniture Segment

The Group operates its furniture business under our newly established wholly owned subsidiary, ELKDesa Furniture Sdn Bhd (“ELK-Desa Furniture”), with our house brand name “ELK-DeSA”.

For the financial year under review, the furniture business commenced operations in July 2015. The business division generated a revenue of RM8.21 million and profit before tax of approximately RM30,000 for the nine (9) months period ended 31 March 2016, as the division is still in its infancy stage. Moreover, the post-GST period has seen a downward adjustment in consumer spending pattern. This adjustment period was longer than anticipated during the current soft economic environment.

The Group will continue to build a large distributing channels involving retail outlets, wholesale to dealers and export market. With a sizeable base, the Group can ride on the cost and product advantage to remain competitive in the furniture market.

Currently, we have four furniture retail showrooms located in Klang and Shah Alam, and we will expand our retail presence cautiously to avoid adverse competition with other furniture retailers.

In April 2016, ELK-Desa Furniture started to distribute furniture products under our house brand ELK-DeSA via a vast distributing network of more than 300 furniture retail outlets in Malaysia.

In addition, we export our furniture to other countries.

Riding on our team’s experience in sofa manufacturing, the division has started sofa production to complement with the whole business.

Our products were showcased at the Malaysian International Furniture Fair 2016. At the fair, ELKDesa Furniture received the “Platinum Award – Judges’ Commendation Award” for outstanding achievement in furniture design. This recognition serves as an inspiration for our furniture division to strive for more excellence in future.

Corporate Developments

During the financial year ended 31 March 2016, the Group has established three (3) new subsidiaries to undertake its furniture business. The Board is mindful of the intense competition in the furniture business but believe the long term prospects for the business remains positive given the huge international and domestic furniture market.

In October 2015, the Company completed a rights issue of 59,800,000 new ordinary shares of RM1.00 each (‘Rights Share(s)’) on the basis of one (1) Rights Share for every two (2) existing ordinary shares of RM1.00 each in the Company. The Rights Shares were successfully listed and quoted on the Main Market of Bursa Malaysia. The proceeds from the rights issue will further strengthen the financial position of the Group and enable the Group to grow its hire purchase business at a steady pace.

Starting from 15 April 2016, the eight (8) years Irredeemable Convertible Unsecured Loan Stock (“ICULS”) of RM100 million in nominal value with coupon rate of 3.25% per annum that was issued on 15 April 2014 had become convertible to new ELK-Desa shares at a conversion price of RM1.18.

Dividend Policy

The Board endeavours to build a sustainable business and to create value for our shareholders as well as to reward them with consistent dividends. We are pleased to inform all shareholders that in August 2015, the Company has announced a dividend policy to distribute not less than 60% of the Group’s annual net profits after tax to shareholders of the Company with effect from FYE 2016.

For the financial year ended 31 March 2016, the Board has declared an interim single tier dividend of 3.25 sen per share. The interim dividend, amounting to RM5.68 million, was paid on 30 March 2016.

The Board is pleased to recommend a final single tier dividend of 3.50 sen per share in respect of the financial year ended 31 March 2016, subject to the approval of the shareholders at the forthcoming Annual General Meeting. The total dividend for FYE 2016 would be 6.75 sen per share.

The dividend payout ratio for FYE 2016 would be more than 69% of the Group’s annual profit after tax, as compared to 49% in the previous financial year, which is in line with our dividend policy.

Outlook and Prospects

According to Bank Negara Malaysia, the Malaysian economy is expected to grow at a slower pace in year 2016 where private consumption growth is projected to moderate to a lower level. Households are expected to continue making expenditure adjustments due to the higher cost of living arising from the implementation of the GST and changes in the administered prices of several goods and services. Additionally, household spending will be affected by weaker consumer sentiments due to uncertainty on labour market conditions, financial markets and ringgit performance.

Despite the lower domestic growth projection for year 2016, the Group is not likely to experience any slowdown in the demand for second hand cars financing for the financial year ending 31 March 2017 as the business segment that the Group is currently operating in, is still relatively small as compared to the overall auto financing industry. Furthermore, given the uncertain labour market conditions, demand for second hand cars may increase as opposed to new cars.

Downside credit risk remains for the Group’s hire purchase segment as consumers and businesses make expenditure adjustments in response to the lingering effects of the GST regime. Therefore, the Group will continue to place strong emphasis on close monitoring and efficient debt recoveries as well as follow-up mechanism, to minimise the impact.

The Group will continue to strategically operate in the underserved niche market and focus on the small value second hand car financing. The business strategy will also be constantly reviewed to ensure the Group continues to stay relevant in the industry and at the same time keep credit risk exposure at a reasonable level.

As for the furniture segment, the Group will focus on ensuring operational efficiencies in the various divisions (i.e. retail, wholesale, export and manufacturing) that have been established.

The Board is optimistic on the Group’s future performance and will continue to grow its hire purchase portfolio without compromising on the quality of the assets. At the same time, the furniture segment is not expected to make any significant contribution to the Group’s profit in FY2017.

Acknowledgment

On behalf of the Board, I wish to express my sincere appreciation and gratitude to the management and staff for their hard work, dedication and commitment that have contributed to the growth of the Group.

To our shareholders, business associates, financiers, advisors and regulatory authorities, I wish to thank them for their continued support, cooperation and guidance.

Teoh Hock Chai @ Tew Hock Chai

Chairman

30 June 2016